Real Life Facebook, an Older YouTube Skit from Australian Comedian, Kinne

(Click picture below to access YouTube Clip)…

Real Life Facebook, an Older YouTube Skit from Australian Comedian, Kinne

(Click picture below to access YouTube Clip)…

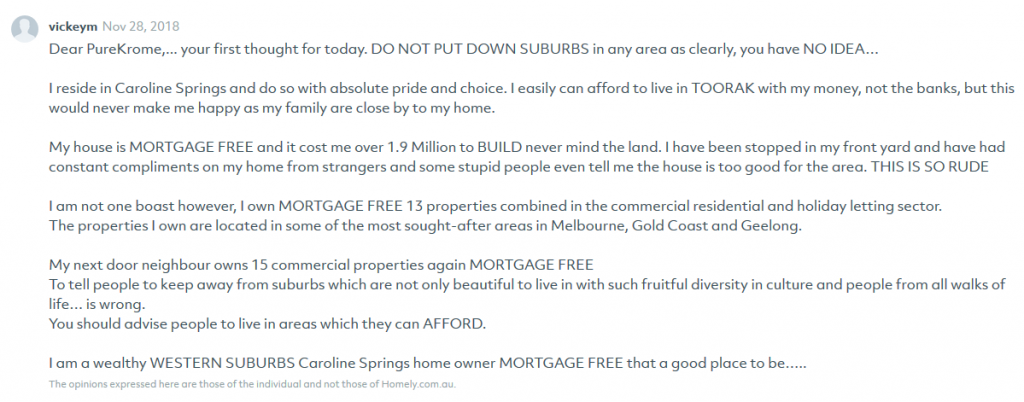

Caught my eye while cruising homely.com.au. Inflated ego award goes to… *Drum roll*…

“I’m better than all of you, you are all losers, look at me me me, it’s all about me!”

Asking to have one’s backside kicked. (Figuratively speaking of course)