Real Life Facebook

Real Life Facebook, an Older YouTube Skit from Australian Comedian, Kinne

(Click picture below to access YouTube Clip)…

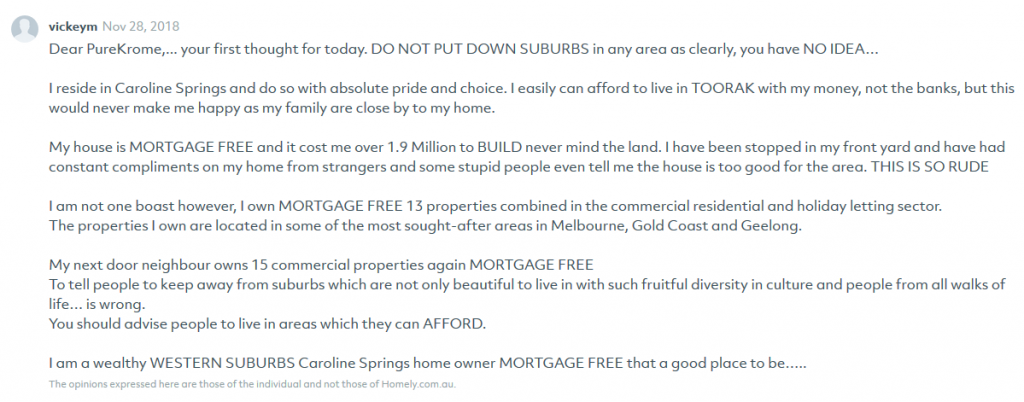

No holds barred bragging

Caught my eye while cruising homely.com.au. Inflated ego award goes to… *Drum roll*…

“I’m better than all of you, you are all losers, look at me me me, it’s all about me!”

Asking to have one’s backside kicked. (Figuratively speaking of course)

Featured gallery from the Photo Archives.

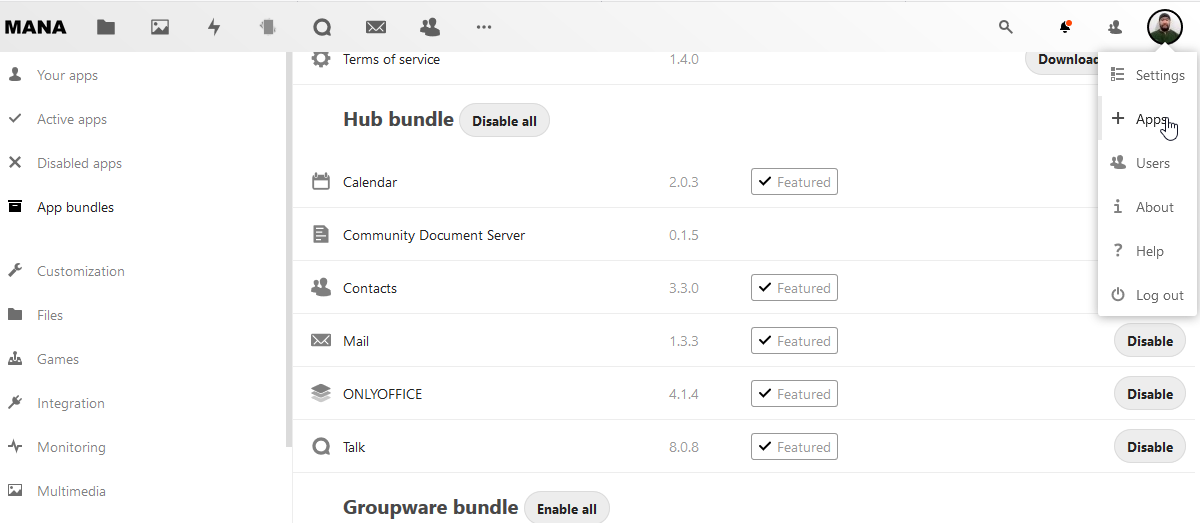

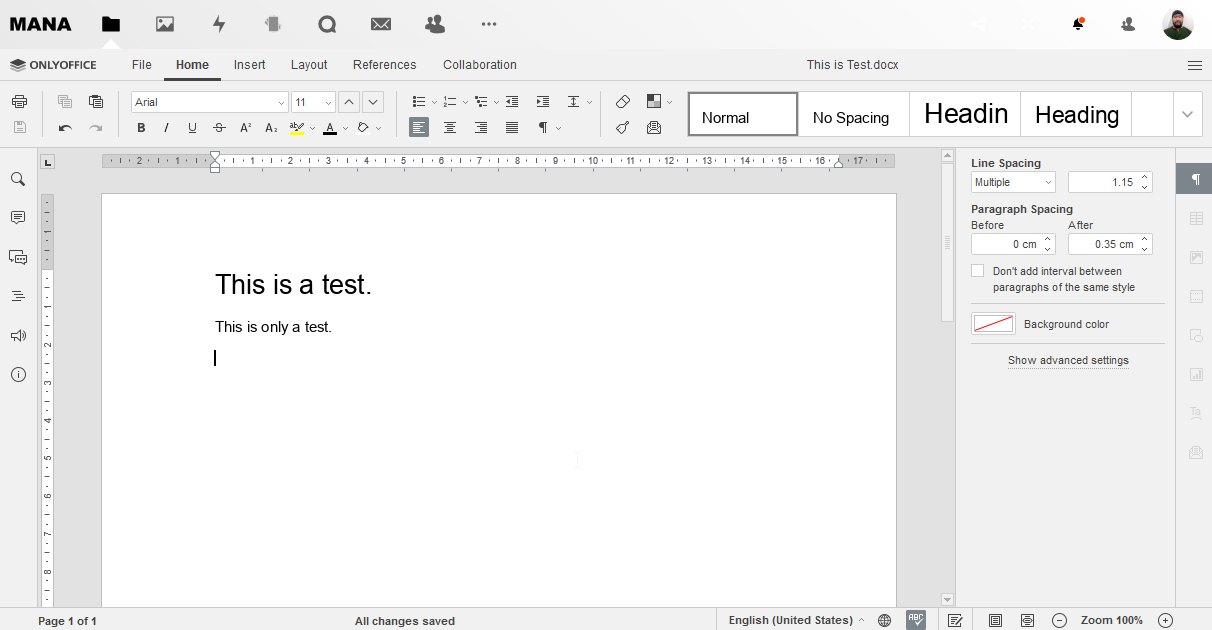

NextCloud Snap Packages updated to version 18

Just saw a notification that the Snap NextCloud installation I had running had been updated to version 18.0.4. For me this is fairly significant in that you can now self host your own office suite with “ONLYOFFICE” community edition and if you are ambitious enough, allowing the option to move away from the likes of Google and Microsoft (Office 365).

The catch is that you have to set it up yourself by installing the needed Apps. To do this, go into Profile, then Apps and enable “Hub Bundle” (or at the very least “Community Document Server” and “ONLYOFFICE”)

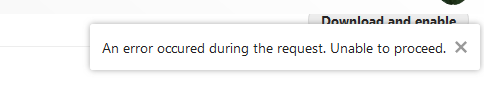

Upon doing that, I ran into headaches with this vague and unhelpful error message…

Diving into the nextcloud.log… (the location of which is going to be different depending on your installation. Helpful I know.)

"message":"Allowed memory size of 134217728 bytes exhausted (tried to allocate 315857416 bytes)

I had to fire up an SSH session and send the following commands (applicable to Ubuntu Linux). One to increase the memory limit to 512 Megabytes and the 2nd one to restart the NextCloud service….

sudo snap set nextcloud php.memory-limit=512M sudo snap restart nextcloud

Back in NextCloud’s web interface, navigated back to Apps section and tried Enabling the Hub bundle again. Still got a flipping error!

"Cannot declare class OCA\\Talk\\Migration\\Version2000Date20170707093535, because the name is already in use at xxxxxxxxxxx"

At a loss as to now what to do, I then went through for each App under the Hub Bundle, clicking on Enable one by one and it worked for some completely and disconcertingly unknown reason (No errors happened this time around… have no idea why, sorry.)

After that, I went back to my Files and had a play at creating new word documents… (Success I guess)

Seems to work pretty well for a family user set up, even on the lowest tier VPS plan with my provider. (1CPU / 2GB RAM). Included with the ONLYOFFICE suite is a Word Processor, Spread Sheet and Presentation (slides) application. At the moment, the biggest issue I can see is the lack of a working spell checker on the community server plugin as reported here and here which I feel is fairly fundamental to a Word Processor. Little bit concerning is that the web browser based (core or plugin based) spell checkers don’t appear to work inside of it either.

I think at this stage, for word processing, will stick with using the visual Markdown editor “Text” (by Julius Härtl) and continue trailing out the Spread Sheet application by doing my Tax return on it and then reporting back here.

Despite the messing around and troubleshooting to get it working I’m overall pretty otherwise pleased with the “Only Office” implementation (Community Server plugin) as a proof of concept.

Say Cheese

A little bit of comedy: Troy Kinne – Say Cheese. (Click picture below to access YouTube Clip)

Retro City

Revisiting an old rendition of SimCity Classic while stuck at home…

Downloadable from the Windows Store as RetroCity. Beware, Windows Store pop up nags.

.NZ Domain Yearly registration prices are to rise.

The .nz Domain prices are to rise after InternetNZ announces wholesale price increases. Claim is that registrations are falling. Monthly Registration statistics can be found here… https://docs.internetnz.nz/reports/

I believe a lot of the more recent new domain registrations were speculative after the release of the direct second level registrations under .nz and feel that may be it’s just a gradual decline back to the mean.

Increasing prices in my view will no doubt accelerate the so-called decline. I plan to have a look into their financials when I get a chance. (I don’t expect to find any irregularities – though worth checking for my own edification)

Drowning does NOT look like drowning

An interactive website I found that provides information on recognising signs of drowning in a child along with the opportunity to practice recognising these signs.

URL: http://spotthedrowningchild.com/

The key take away here is that… Drowning does NOT look like drowning

Quoted from the site… “Except in rare circumstances, drowning people are physiologically unable to call out for help. The respiratory system was designed for breathing. Speech is the secondary or overlaid function. Breathing must be fulfilled, before speech occurs.”

The Youtube videos utilized on the site are from the Lifeguard Rescue (Channel)

Sepitone Skies

Sepitone coloured skies in Auckland from the Australian Smoke fires at approximately around 6:00 p.m. No filter applied.

NRMA Car rental division (Was Thrifty, now SIXT Australia)

Update 7th December 2021: Much of the original Thrifty Australia operational structure has been rebranded as SIXT Australia. NRMA’s master license for Thrifty expired earlier this year and they have now changed over to be SIXT Australia.

This post refers to when NRMA’s Car rental division, Kingmill Pty Ltd, were trading as Thrifty Car and Truck Rental Australia.

—

Dare I say it, I have had largely reasonable experiences with the ‘Thrifty’ car rental brand in Australia. Vehicles provided have predominantly been received in clean, tidy and good condition. Majority of hires have been smooth with one disappointing experience in the middle involving one of their licensees operating in Suburban Melbourne who I felt were dishonest and were also caught posting fake reviews to boot (Lawrence Vic Pty Ltd). Continue reading “NRMA Car rental division (Was Thrifty, now SIXT Australia)”

A2 Hosting Shared tier impressions

Update: 27 December 2019 – Have now received confirmation of a refund from A2 Hosting.

—

At the same time of setting up my Digital Ocean droplet as part of the Early December site move, created an account with A2 Hosting on their shared “turbo” server (with “Performance Plus” add on), drawn in by the positive reviews on Webhostingtalk and their up to “20x faster” marketing along with their 66.6% off Black Friday Specials

I copied NUI.NZ to both a Digital Ocean Droplet and to my account on A2 Hosting (both at their respective Singapore data centers) to begin comparing the two. After some testing, discovered that the Digital Ocean droplet performed faster for my use case in terms of responsiveness, speed and consistency.

- NUI.NZ on Digital Ocean loaded up in 3.2 seconds on Average.

- NUI.NZ on A2 Hosting shared turbo loaded up in 3.9 seconds on Average (with Caching enabled and A2 Optimisation plug in installed) but was bursty / less consistent and felt so much less snappy and responsive overall.

A2 Hosting’s marketing had led me to believe that I would have access to 2 CPU cores and 3GB of RAM on a burst basis versus the 1 CPU and 1GB set up with my 5 USD/month Digital Ocean VPS droplet.

Additionally, setting up their A2 Optimisation plugin they had developed for WordPress and then clicking “Optimize all” will crash even a shiny new and fresh install of WordPress into the white pages of death. If the aforementioned didn’t crash it, enabling Memory Cache on the WordPress instance will most certainly crash it. After much frittering around I did manage to get the plugin to work but only in rather limited situations I’ve found. It is my belief A2 Hosting should seriously consider removing the plugin as it is I believe impacting their brand.

I’m also a little bit disappointed with how they have structured their so called “any time” refund policy. Within 30 days, you can get a full refund, after 30 days however, what they will do is re-bill you at the regular rate for the rest of the paid up period then give you what is left. I struggle to think of anyone who will be (willingly) paying regular rate given the performance I’ve seen of their shared hosting product. I have to admit, this has darkened my regard I have towards the A2 Hosting brand.

I have now requested a cancellation and refund under A2 hosting’s 30 day risk free policy. Given prior experience with Shared hosts and my impression of some of the way A2 Hosting do things, I don’t have enough faith to see out the full 3 years with them

—

I have to admit, over the years, I’ve started really souring of Shared hosting in general and believe it should be left for only of the most insignificant of web projects (Personal websites). Sure, if you are a largely a neighbourhood bricks and mortar (Vet Clinic, Dentist, Hairdresser, etc) business and just need a site with a handful of static pages (and may be a blog, but would argue at a stretch) then Shared Hosting may be Okay.

If on the other hand you’re a business who is almost entirely dependent on the web, it should go without saying you shouldn’t be using budget shared hosting… ever. Unfortunately, I see many businesses and online only retailers for what ever in their right signing up for shared hosting, installing Woo Commerce / Presta shop and once their site goes down or goes slow, they are seen screaming to high heaven on all the support channels and web hosting forums begging for a resolution.

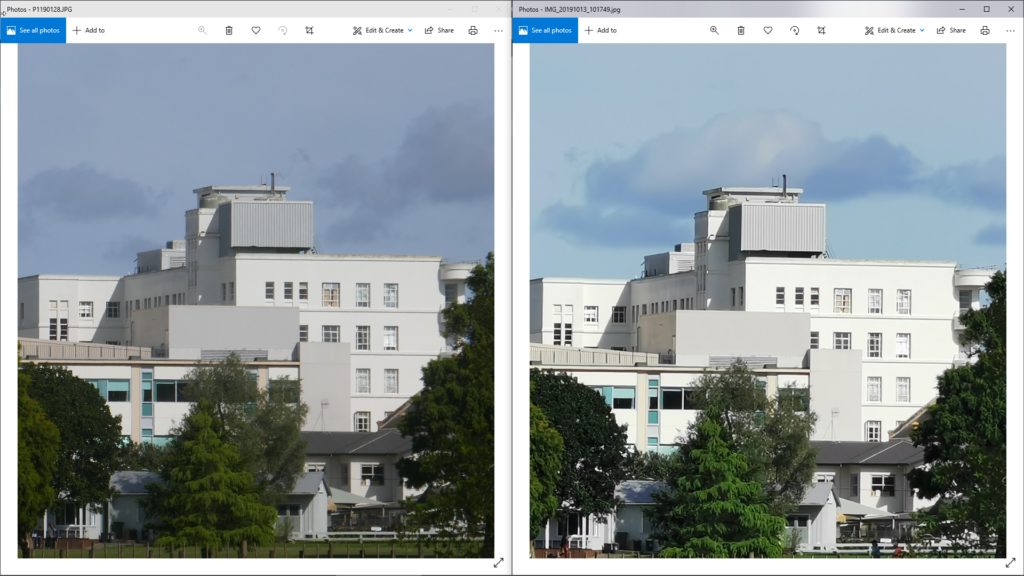

Huawei P30 Pro Camera – Hybrid zoom

Update 13 October 2019 – So took the Huawei P30 Pro and compared it to the Panasonic TZ110 and another quick test…

At x5 zoom…

Native zoom for the P30 Pro’s x5 Camera. To my untrained eye, it is fairly similar enough in detail. The TZ110 may be a touch more natural in detail and colour reproduction.

Auckland Local Body Elections

Admittedly, it’s been difficult to figure out who to put a tick against for the Mayor vote for the Auckland Local Body elections. I’ve spent at least two hours in total reading about and researching all the candidates over the last week.

Some may argue that spending two hours is a total overkill, but admittedly, I do hold Civic responsibility quite seriously, and the fact that we do get to vote as part of a democratic nation is something I consider extremely important.

Resources reviewed and canvassed include…

- The Voting instruction booklet / Candidate information. Same information is available on the Auckland Council Website. (Just click “+ More search options” then “Show mayoral candidates”)

- The Spinoff NZ – Local Policy Website

- Radio NZ – Mayoral Candidate Debates

- The Candidates own resources, such as their own personal (campaign) website and social media accounts.

So far my research has come up rather inconclusive. The decision made more difficult is the candidate information appears to vary between mediums (i.e Candidate information booklet vs the Candidate’s website).

Shaz’s $2 and more

Tongariro Alpine Winter Crossing

Saturday 21st September 2019 – Tongariro Alpine Crossing. Click photo below to access the gallery and trip notes…

South Island Trip (and NZ Shareholders conference)

Flew down to 30th to attend a New Zealand Shareholder’s Association conference in Christchurch. Did some day walks afterwards, including Mount Isobel and Mount Fyffe in Kaikoura.

Swazi Apparel to move part of their manufacturing to Thailand

Swazi NZ, Davey Hughes in a YouTube clip has announce they are moving production of their Fleece and Base layer clothing lines from their Levin Factory (here in New Zealand) to Thailand. The technical garments such as raincoats and jackets will still be made in New Zealand.

This in my view represents a not so insignificant change of direction from their original brand values and which they built the brand on.

South Island Road Trip

Pictures from a solo South Island Road Trip. Highlights include Roy’s Peak (in Wanaka) and Mueller Hut (Mount Cook National Park). Click Picture below to access the galleries.

Software Disenchantment

I concur with Nikita Prokopov’s view of the state of the Software Development Industry: https://tonsky.me/blog/disenchantment/

Where we are today is indeed not ideal.