Another visit to Coromandels, this time to explore around Wentworth Falls, it’s mid tier, Whangamata Track, and part of Maratoto Track (to the little shelter / clearing for lunch) before returning back the same way.

Well packaged for Delivery. Box containing a Microsoft Office 365 box wrapped in Air Pillows. The only important bit was a line of code to activate your Office 365 subscription online.

Of course an argument could most certainly be made that it would have been cheaper and easier to simply E-mail me the code… though obviously packaged like this as a “matter of process” / “Matter of course” and to their credit, it did showed that Noel Leeming takes the effort to ensure goods are packed in a way to minimize the chance of damage during transit.

It seems for (at least) Friday 8th December 2018 and Today, Saturday 9th December 2018, Air Vanuatu (NF) Flights that use the De Havilland Twin Otter aircraft have allegedly all been cancelled. Who the flip knows when they will be back in Action. Known locations affected include (but NOT limited to)…

Upon arrival to Craig Cove Airport on Friday (Yesterday) Morning, The agents in contact with Air Vanuatu head office keep announcing ever later estimated arrival times and relayed excuses from Head office from Mechanical Failure to the weather as reasons for the delay. After 2 hours of delay, ended up ringing Air Vanuatu Head Office myself, but they kept referring me back to the agents on the ground who in turn were similarly frantically via phone trying to get a grasp of the situation from Air Vanuatu Head office.

At about 4 hours after the flight was supposed to arrive, the agents announced that the flight had been cancelled and suggested that the next flight out of Craig Cove would be on Tuesday 11th December 2018 (Too late for me). Ended up calling a private charter flight to get us off of Ambrym allowing us to return back home to New Zealand as scheduled on the next morning.

Reviewing the flightradar24 upon finally returning home this Afternoon (As scheduled), it was revealed that all flights using De Havilland Twin Otter had been cancelled… Continue reading “Air Vanuatu Domestic Twin Otter Flights Cancellations”

Extended weekend spent in Tahiti. Click picture below to access the gallery and trip report…

My Feeling is the same as it was in 2012, If one needs a house to live in and it looks like one is in a position to finance it (with a buffer one would deem comfortable) then by all means, I would look to buy a home.

Attempting to “time the market” is at best difficult if not impossible. I can’t say what would happen in the next few years. For all I know, we could have a volcano blow up under Auckland or another equally unforeseen disruptive event and houses prices could then crash through the floor. At the moment, all the information I’ve seen around the place suggests that house prices are on track for single digit percentage gains across the board in New Zealand for the next year or two, but I reiterate, who the freak knows in this bizarre market, particularly given the distortive effects of a decade of seemingly endless and inefficiency encouraging “stimulus” Continue reading “If you want to buy a home to live in, then buy one”

Loop walk around the Kuraeranga Valley. Booms Flat + Whangaiterenga Track, click picture below to access gallery…

Karangahake Rivers, being Ohinemuri and Waitawheta Rivers after sustained rained. Click picture below to access gallery…

Went to see the Super volcano showing at Stardome.

It is an older (2005/2006) film projected on to the dome ceiling of the Star dome. Being part of Stardome’s School Holiday Program, Family groups with Kids are likely to derive the most enjoyment from it.

The actual “Super Volcano” film clip (as shown in the trailer in the aforementioned link) runs for about 23 minutes starting from Indonesia and describing it’s lasting effect on the world, through the “Great Dying”, before zooming out and examining the volcanoes of other planets.

The remainder of the time was utilized as a generalized star light presentation of the Solar system, aimed primary at younger kids interested in astronomy. Total Run time for the content by itself is 40 minutes (Super Volcano film + Solar system presentation). No photos to show this time (as photography is prohibited inside the Stardome room itself)

May be alright value with Family groups on a $40.00 (+ Booking fee) Family pass. (In contrast to say a group of Adult aged friends at 13.50 each where it perhaps falls on the expensive side)

22nd July 2018 – Day Trip out towards the Dargaville direction to Hike up Mount Tutamoe Track and Hukatere Reserve (Both scheduled to be closed). Click picture below to access gallery…

Another spur of the moment (Snap decision) walk on Saturday 14th July 2018, this time around Te Arai and Mangawhai. Click Picture below to access gallery…

Explore around the Eastern Side of Coromandal. Bays explored include Pokohino Bay, Pakahakaha Bay and finally Opoutere Bay.

To Access the gallery and brief trip notes on NUI.NZ, click the picture below…

Day trip up north to visit Waipu Caves in the Whangarei District, click picture below to view album…

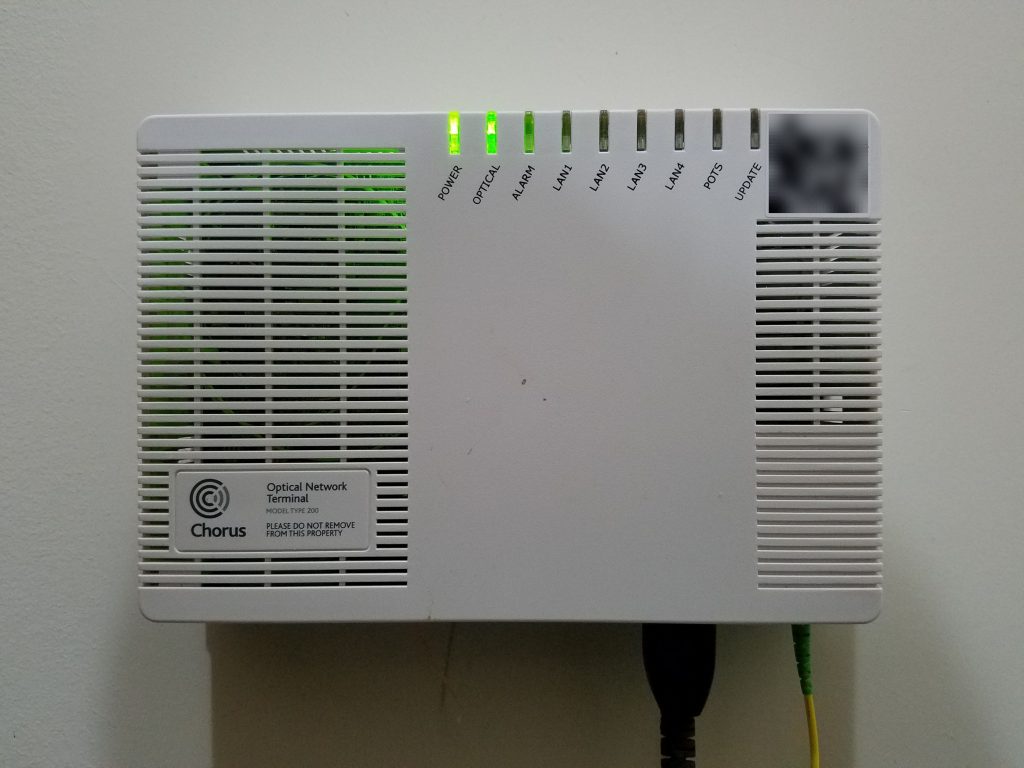

Fibre is finally installed after being convinced by a passing Chorus Man in a Van to get connected. So which provider to go with, I wouldn’t know. Still on my ADSL1 copper connection.

After a few false (scheduling) starts, the Chorus Technician managed to eventually come along, lay down the Fibre and install the Optical Network Termination (ONT) box. The job he did looks pretty professional overall.

Probably alone in feeling this way, but would be keen to learn more utilizing Fibre’s potential towards improving people’s lives overall, through initiatives such enabling more to work from home and improving of connectedness between friends and family, etc (and perhaps less about it simply being another means of “Feeding the masses a steady diet of Bread and Circuses” in terms of piping passive Entertainment and Professional Sports into People’s homes).

Quick Drop in visit to Kaipara Coast Sculpture Gardens en route back to Auckland. Click Photo below to access the gallery…

They recommend about 1 and half hours to walk around. Could easily spend 3 hours there if you include Don’s loop at a leisurely pace. Hills are moderate (Easy for a seasoned hiker, may be challenging for though for the less fit)

Walk with the Auckland Hiking Group Meetup to Waipu, click photo below to access gallery…

Weather was pretty Rainy through much of it, with fine breaks.