Yes, Facebook is indeed down.

Facebook is indeed down. This includes their other properties as well such as Instagram, WhatsApp and Occulus. Looks to be a DNS or routing issue (Botched BGP setup).

Read more here… https://news.ycombinator.com/item?id=28748203 and here… https://arstechnica.com/…/facebook-instagram-whatsapp-and-oculus-are-down-heres-what-we-know/

It is why I have continually expressed concerns personally regarding allowing ourselves to collectively entrust too much of our lives singularly on the proprietary services of what is essentially is a single for profit driven entity.

TD Ameritrade Ending their business with NZ Clients

Received a generic message from TD Ameritrade advising they’re effectively ceasing business with New Zealand Clients…

—

Dear Fergus,

Following an internal assessment of our international business, we have determined we will no longer open or maintain accounts in certain international jurisdictions. We are contacting you because your account is affiliated with at least one of these jurisdictions. We regret to inform you that we will no longer permit the opening or maintaining of accounts in New Zealand effective November 1, 2021. Continue reading “TD Ameritrade Ending their business with NZ Clients”

Auckland Light Rail – My own thoughts

Dropped in to the Auckland Light Rail marquee at the Balmoral Flea Market to try and get a better understanding as to what this project is all about. The current focus they have advised is that the project most certainly is going a head and we are now choosing between “Light Metro” and “Modern (street level) trams”.

Promotional brochures can be found here.

Overall, they’re a friendly and approachable bunch manning the stand and were found to be willing to at least provide their take on any questions and concerns I had about the project.

They were at pains to note that this project is not about trams alone, but a transport and urban building project initiative combined where development will be intensified along the Tram routes. Continue reading “Auckland Light Rail – My own thoughts”

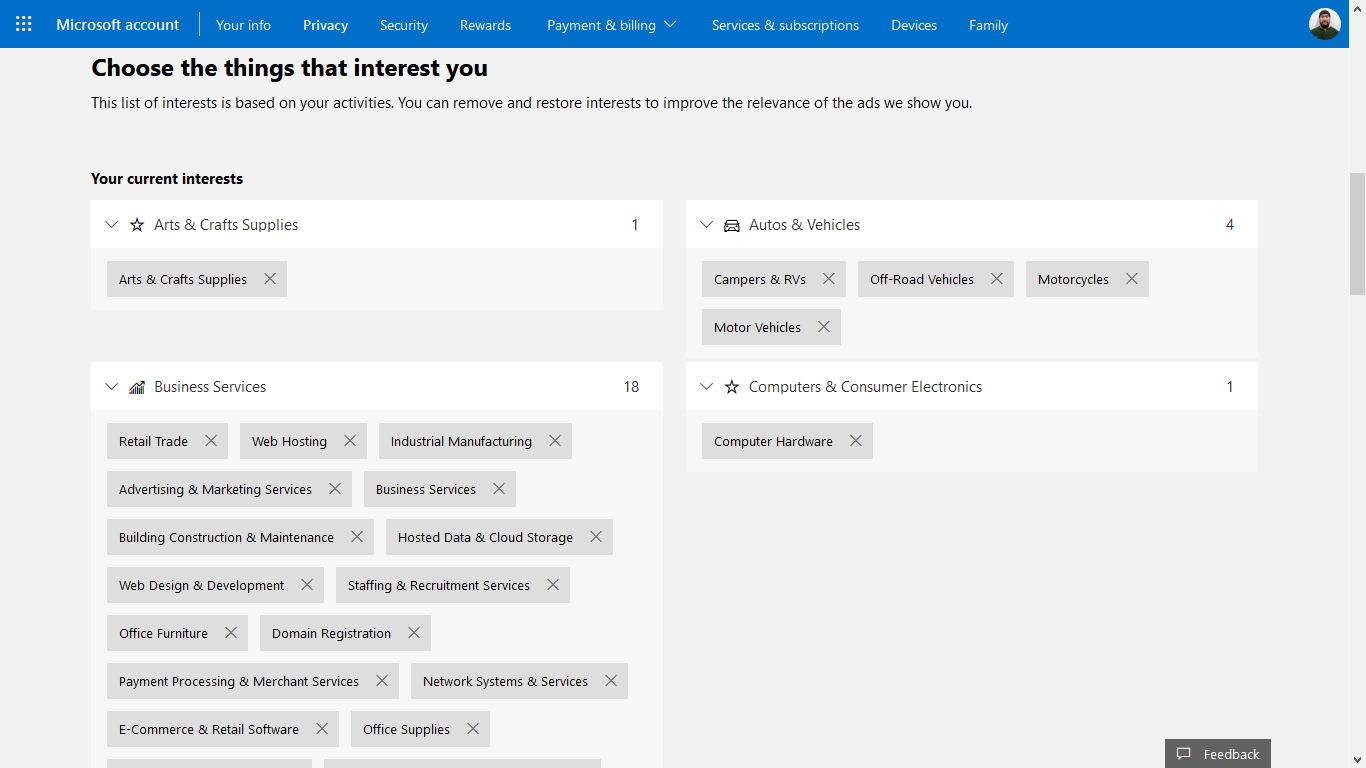

Corporate collection of personal data

Discovered this page in the privacy section of the Microsoft account page…

Seems there were collecting a lot more data than I originally thought in spite of turning off the Telemetry (including Advertising ID) on all Window 10 systems I use.

Many of these queries seemed unique to the queries I threw in to TradeMe’s search. Went to view TradeMe’s privacy policies and apparently they do have some data sharing arrangement with the “Big Tech” companies including the likes of Google and Facebook.

I guess my concern is that the more information that these Big Tech companies know about us, the more powerful (in a concentrated way) they essentially become. I’m not sure how I feel about the continued concentration of power in the hands of a few profit companies. May be some form of ‘Serfdom’ would come out of it where we lose our “individual agency” or “Self determination” and become subservient to the Power Elite… I don’t know.

Te Ika-a-Māui Autumnal

Hidden (Undisclosed) Fees in Hire car company agreements – Not a myth unfortunately

Update 7th December 2021: NRMA’s master license for Thrifty expired earlier this year and they have now changed their branding over to be SIXT Australia which includes Lawrence Vic Pty Ltd’s network of outlets throughout Suburban Victoria.

—

In short, less than upfront (“shady”) behaviour from rental car companies does exist. This is in spite of people, particularly on various online travel forums who are often quick to come to the defence of car hire companies through pointing out that the hirer raising a complaint is the one in the wrong and who simply didn’t read and understand the agreement and/or contracts. From personal experience, this is certainly not always the case.

Ending up deciding to send Lawrence Vic Pty Ltd Originally trading as Thrifty Car and Truck Rental Victoria (since changed over to be SIXT Car Rental Victoria as of 2021) a fairly stern and direct Email over the weekend firmly stating that due to their lack of disclosure, they are not entitled to retain the 3.5% Administration fee that they had applied to my account (over the top of the damage/repair charge from a small roo jumping into the side of the vehicle) back in 2018 and if they did not refund that portion of the administrative fee by the “close of business 5pm AEDT, Friday 19th March 2021”, I would be instituting further recovery proceedings under Victorian State and Australian Consumer Law in order to have the amount in question returned back to me. To recap, in 2018… Continue reading “Hidden (Undisclosed) Fees in Hire car company agreements – Not a myth unfortunately”

Random Geek Notes

Just some notes to self…

- Upgrading Raspberry Pi 4’s Python installation from Python 2 to Python 3.8…

https://installvirtual.com/how-to-install-python-3-8-on-raspberry-pi-raspbian/ - Backing up a Matrix Synapse (federated chat) server

https://github.com/matrix-org/synapse/issues/2046 - Backing Up NextCloud

https://www.addictivetips.com/ubuntu-linux-tips/backup-nextcloud-snap-installation-on-linux/

Cold calling investment boiler room scammers

I had another call from these scammers. This time purportedly from a number called +61 2 7147 0151 (or 02 7147 0151 if in Australia)

They keep changing their company name. First, the lady said they were calling from “Yahoo Finance” offering sophisticated investment private placements.

Then a man calls from “Elite Capital” saying he was referred from the above and they are offering retail investment opportunities. If you receive these calls…

DO NOT confirm your personal details. Hang up immediately.

The Email address they quoted back to me was a “honey pot” trap (used for trapping and detecting Scams and spam) confirming they had indeed gleaned the Email address via a shady source.

Given the amount of time wasting calls I get from them, it is getting to the stage where will be tracking them down.

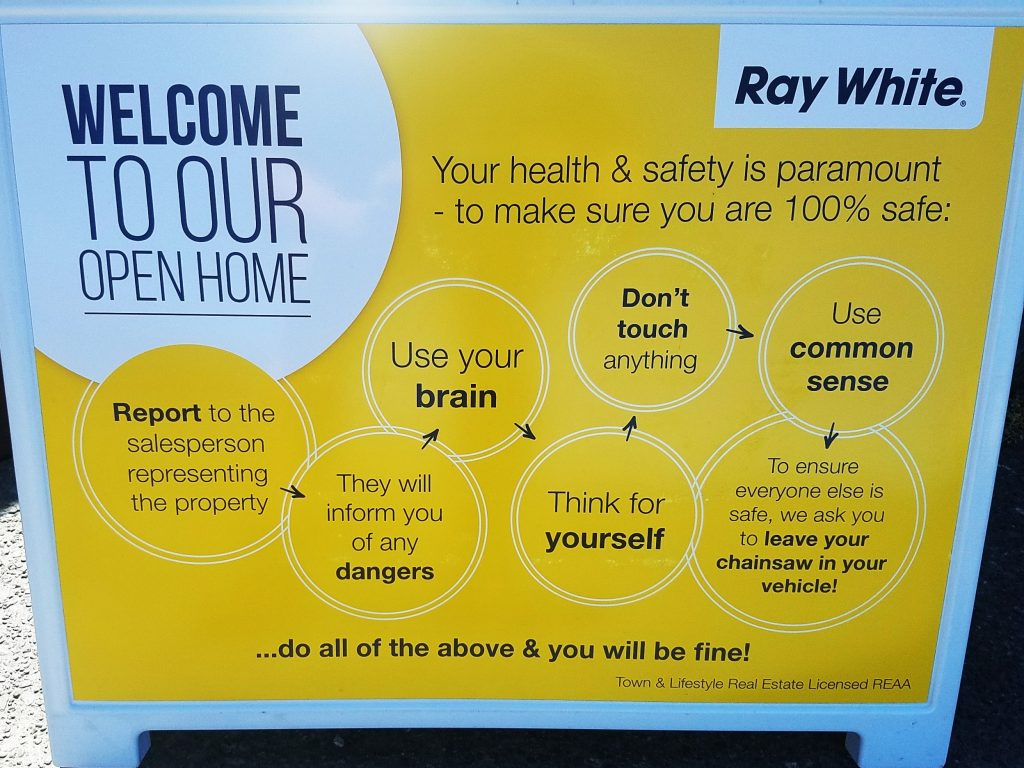

Leave your chainsaw in your vehicle

Ray White Open home sign in Rolleston…

A family has now moved in to the property I most recently purchased, with an Alarm system to go in very shortly.

I have noticed many houses that were for sale have since gone straight into the rental pool. Anecdotally, it appears to be happening all around the country. Consequently, should the trend continue, I would not be surprised to see that we eventually end up with a nationwide Rental glut at some point. May be the tables will then finally turn in favour of tenants and instead of Renters scrambling for properties to rent, Landlords would be scrambling for Tenants.

We don’t know how long this low interest rate environment is going to last. The government to be honest (both current and past) have been exceedingly coy as to their apparent lack of will do actually do anything concrete about the housing affordability and the accelerating inequality in this country.

Earnslaw Burn + Glenorchy Lupins

Canterbury Road Tripping

Reduction of LVR on Investment property questioned

In my mind, the Loan to Value ratios (LVR) for investment properties should have never been reduced by the Reserve Bank of New Zealand from 35% to 20% and I struggle to understand why it has.

Will probably now join the investing hordes in this Property pile up owing to a decade of a dearth of any real investment opportunities. There’s only one or two areas in the South Island of NZ which I feel still presents value, every other area in NZ has gone full euphoric FOMO. May be the continuous money pump will never turn off (or won’t turn off for the foreseeable future) and the pull back of global asset bubbles may not eventuate in any significant sustained scary way. No one knows.

Seems to be also a lot easier today to get pre-approved for a loan in New Zealand than it was say a few years ago, the banks appear to be willingly to lend more (In my view, a jaw dropping and gobsmackingly lot more) and going through the process earlier this week does perhaps make it easier to understand why the Housing Market bubble refuses to burst and instead continues to inflate.

Again, the only risk factors to the asset markets on the radar is food security (which appears to have receded recently) and Civil Unrest which appears to be subjectively growing around the world, but still appears to be relatively benign (not raucous enough to enact any real change). Seems with all other threats the Central banks seem to be able to just add a few zeros at the end of the Global Money supply and “she’ll be right”. But who the flip knows…?

The NRMA and NRMA Insurance are not the same company

Be aware that NRMA Insurance and NRMA Motoring and services (“The NRMA”) are NOT the same company and have been separate entities since 2000 despite the two companies sharing the same brand. Yes, indeed this is confusing as anything whereby even Australians to this day do not even realise the distinction.

I occasionally observe NRMA clients complain about an acrimonious experience on either the insurance or roadside assistance side, mentioned they’ve been members for years or decades, and then state they will now move both their insurance policies and roadside assistance to another provider as retribution.

NRMA Insurance and more recently, NRMA Motorserve (now rebranded simply to “Motorserve”) are actually owned by Insurance Australia Group (IAG).

“The NRMA” (Motoring and Services) have largely evolved in my mind to be more of a travel and tourism company. Their traditional roadside assistance services appear to be increasingly supplied by another, separate company called ClubAssist whose personnel (staff and contractors) are supplied with NRMA branded Vehicles and Uniforms while actually being employed by Club-Assist.

Cold calls from Georgeson a Computershare subsidiary

Turns out the phone calls from +61 3 9415 5000 I’ve been receiving is from Georgesons, a Computershare subsidiary who are using the same outbound number and probably utilizing the same call centre staff as Computershare. While my view may certainly be debatable, I feel personally this impacts on Computershare’s reputation of impartiality as a share registry and Administrative service.

“Georgesons” acting on behalf of APVG (wishing to take over MetLife Care) have repeatedly called me on my number stating the directors of APVG are encouraging MetLife Care shareholders like me to vote yes to the take over offer.

They also wanted me to advise right there and then on the spot which way I would be voting. I repeatedly replied saying that “I have yet to review the information and I am unable to provide you an answer right at this point in time”. I suspect that Georgeson staff are given incentives.

Have finally got around to reviewing the documentation and will personally be voting ‘No’ to the take over offer. In a high level (superficial) nutshell…

- Offer I feel is a little bit too low for the potential future gain I will be leaving on the table.

- (To be direct) Tired of losing access to an ever diminishing range of investment opportunities, given the global liquidity glut courtesy of central bank endless money pump.

NZ Shareholder’s association have also provided their views to their members with the view of voting against the take over offer.

Security Warning – Click Hijack investigation

Investigations so far suggest that there is some type of conditional redirect exploit/hijack being planted on many WordPress websites redirecting search engine referred visitors to fake award/survey sites such as “moviesuddenvalley”, “applefacetook”, “hurryexpectsugar”, “mouthtroubleask”, “ondiesmall”, “thendownmeat”, “makemodernfive”, “sayhitome”, “whateyeweight” among several others typically ending in a “.live” or “.top” address. While this Hijack, as far as I have seen appear to predominantly affect some WordPress websites, I wouldn’t be surprised to learn that this possibly affects other types of websites as well.

In my experience, for sites that are affected, to replicate…

(These most certainly could differ depending on the site affected)

- Prerequisites…

- Needs to be done from an IP address that has yet to access the site in question. (e.g Mobile Data Connection, activate and deactivate airplane mode to get a new IP address)

- Chrome or Firefox browser (Win 10 or Android) in Incognito Mode (No plugins). Reportedly in other variations of the exploit, it only occurs on Safari under iOS

- Search for the site in Google search

- Click on the search result that points to the website. Instead of loading up the website as expected, you get redirected to a hijack site.

The hijack will not fire If you access the site directly (via bookmarks or typing the address directly in the address bar of your browser). This appears to be some conditional exploit based on visitors coming from Search Engines. (e.g by typing the site URL directly into the Address bar, you won’t get redirected) and it looks like it will only fire once per IP Address each week (resets at the start of each week).

I probably should add that many so called WordPress vulnerability scanners online I’ve discovered aren’t even set up to detected this sort of hijack. The scanners based on “Securi” certainly will not detect this exploit, I’ve found.

Other resources…

- WordFence – Removing Malicious redirects

- CoreRecon – Identifying a conditional redirect hack (Beware, annoying pop up)

—

Original Post (Old):

Noticing some apparent weird intermittent redirect hijack on the general web where some sites are allegedly redirecting to some dodgy website with names such as “mouthtroubleask”

Update – 2020-09-11T06:55:00+12:00: Added steps to replicate (from my own experience)

Update – 2020-09-12T18:20:00+12:00: Added note to mention that all of the online WordPress malware scanners I’ve tried won’t detect this sort of hijack.

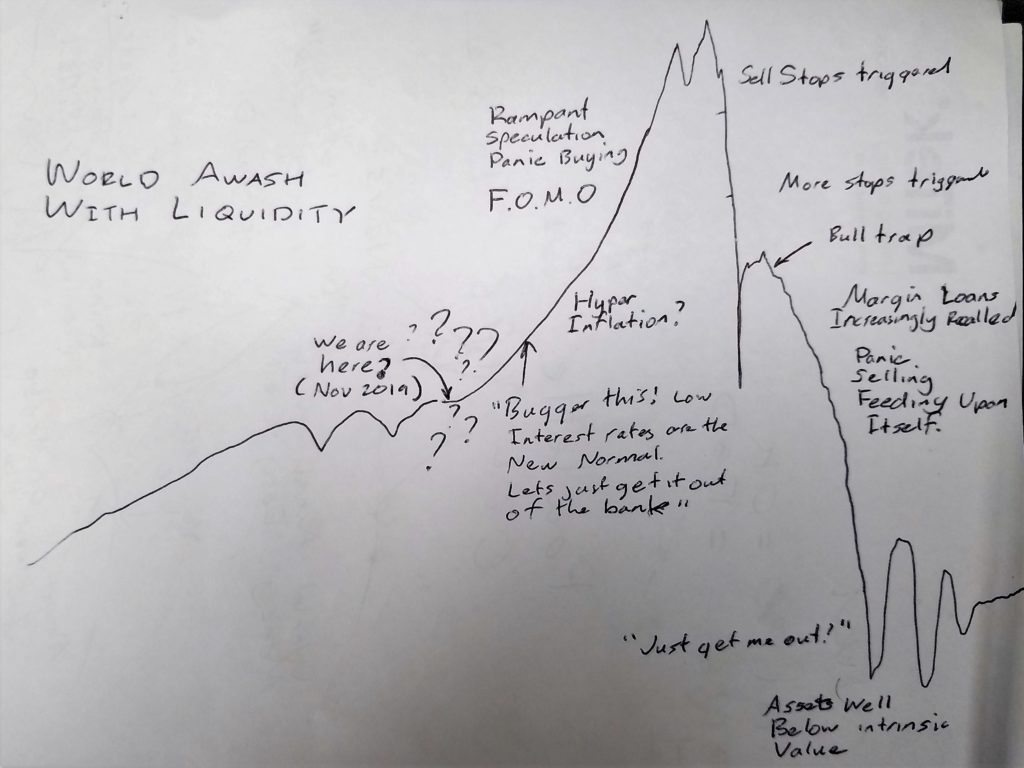

Tech Bubble 2.0

As always, all views expressed in this site is my personal opinion only. Not financial Advice

With Faceborg shares, along with other Tech shares up 6-8% today on something I can’t pin on, I’m declaring this as a classic bubble in formation as the FOMO factor along with mania very obviously increasingly takes hold. As mentioned in my previous post, If I were a short term speculator type who likes riding by the seat of their pants, yeah, I would probably look to go all in.

Also reaffirming view of the bubble scenario. COVID-19 was essentially only an interruption to the larger trend originally sensed…

Not planning to substantially change my current mix of investments, however will probably now look to offload some over valued holdings in the next month or two and then rebalance things. Currently, I see many stocks are valued far beyond any reasonable metric and strongly believe that we are in the midst of a forming classic bubble. Short term, I now expect shares, in particular, technology stocks, to shoot to the sky towards completely absurd levels. Long term, I now expect pain (should the optimism continue).

For longer term folk, who aren’t into thrills and speculating, we may just have to sit tight for a while longer. I believe personally it is fairly clear that things are now running on almost pure emotion / euphoria. Though again, who the flip knows?

Unusual Economics

The original bull trap assessment is well and truly dead I believe. If a down leg as part of a great depression type scenario were to have happened, it should have occurred by July and no later than the middle August. Coming to the view that COVID-19 was a mere interruption to the previously assessed larger trend.

The financial markets from many accounts appear to mostly now be sentiment (emotionally) driven and would not be at all surprised to see Asset prices continue to drive higher as a result of the FOMO affect (before possibly abruptly pulling back), helped along by Federal Reserve support and other interventionist (as opposed to classic free market) policies.

The ‘Efficient Market’ disciples can argue blue in the face that the markets are forward looking and the market is factoring in that things will drive back to normal before we know it, but this argument simply isn’t stacking up for me… at all.

I see a forming Technology bubble, driven by the likes of TSLA whose prices are being driven far beyond what facts, fundamentals and underlying data could ever justify.

While this certainly seems like a classic bubble with the usual tell tale signs including Taxi drivers talking about their gains in Property + stocks, and phases such as ‘Permanently high plateau’ + ‘This is a new paradigm!’ being banded about (i.e this time being “Modern Monetary Theory”), these bubble signs and anecdotes have been going on for an extraordinary long time, considerably longer than what would have normally occurred in a text book bubble. In fact, I’d go as far as to say that I feel the last secular bull run from 2009 to today is highly unusual.

Nothing can be said for certain as all I can see is that much of the information coming out to date is simply too poor to base any meaningful longer term decision making off of (have long held the view that Economics as a discipline is in disrepute), and that the markets in my view have most certainly been interfered with.

—

Current personal investment focus is towards NZ Farm Land where prices on average have not shifted a huge amount over the last decade (See Farm land price Graph at interest.co.nz and REINZ Rural + Lifestyle property data). How one might be able to partake in this may be through funds such as the Booster Private Land and Property Fund, however, the types of properties they appear to cover are rather limited. In regards to other investment related thoughts… Continue reading “Unusual Economics”

Visit to Bridal Veil Falls Waikato

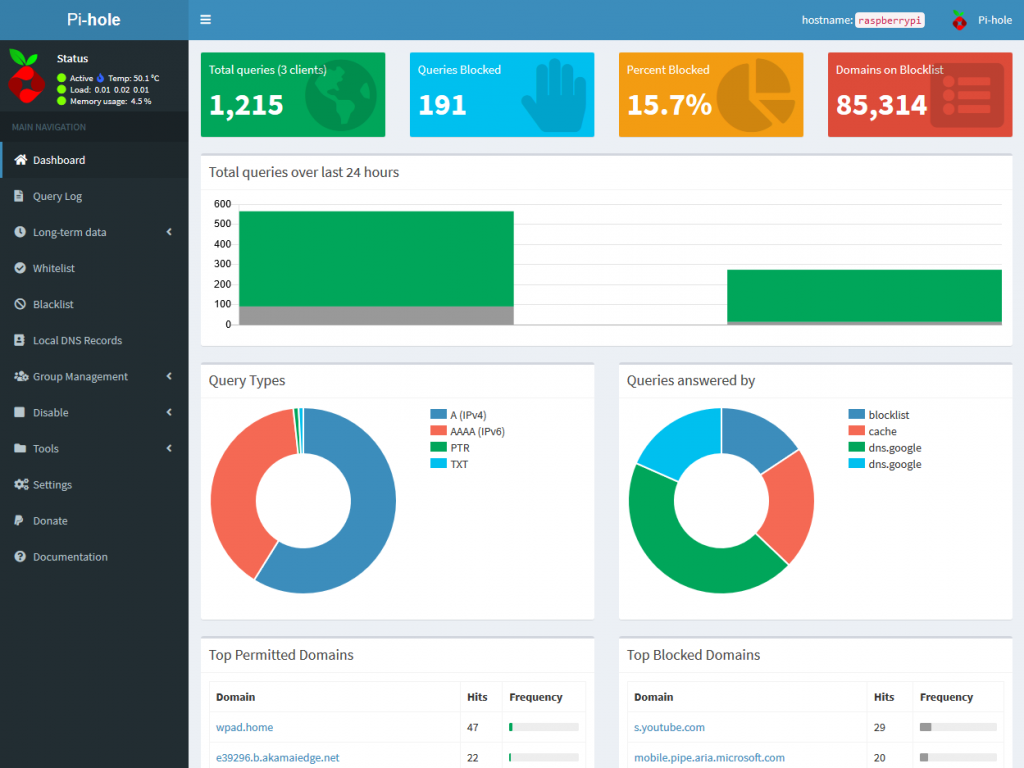

Pi-Hole on a Raspberry Pi 4

Experimented with running Pi-hole on the Raspberry Pi 4 that I have.

The Set up at least for the more tech inclined is very easy, all you had to do was launch a command line prompt and type this command…

curl -sSL https://install.pi-hole.net | bash

After running it for an evening. Thoughts and findings so far…

- Predominantly Does a DNS level block with a blocklist of known advertisement serving IP addresses.

- YouTube is a moving target whereby ads are served from youtube.com itself and therefore very difficult to (completely) block with Pi-Hole.

- Mobile devices with Ad laden apps will perhaps see the greatest reduction in ads.

- The default configuration doesn’t block nearly as many ads as say uBlock Origin installed on Desktop Firefox. This is not a replacement to having Client side ad blocking.

Curiously noticed these appearing in the query-log…

- www.collab.apps.mil

- www.gov.teams.microsoft.us

- www.dod.teams.microsoft.us

Why would Teams try and poll for these addresses is beyond me. It does raise a sufficient level of curiosity that I will be checking this out.