Government agencies and Government appointed authorities in my view need be very careful about increasing the amount of ‘Strict Liability’ offenses on offer, particularly in light of recent reporting in the media about other crimes (such as Ram Raids, Assaults) being left unresolved / unpunished with offenders of these crimes getting off with merely a few months of home detention or even just a warning.

’Strict Liability’ supposedly does away with the need prove a ‘Guilty Mind’ (intention).

As the “infringement fines” base increases and the net widens, we are now seeing more and more otherwise Law abiding people getting pinged over an ever increasing array of ‘Strict Liability’ offences.

While arguably in many cases, the punishment may be warranted, This brings to light a number of issues and considerations…

- Where ordinary people who otherwise have the best intentions and have no intent on causing harm are now no longer able to go about their lives without worrying about the the state coming down on them for what is often an innocent mistake.

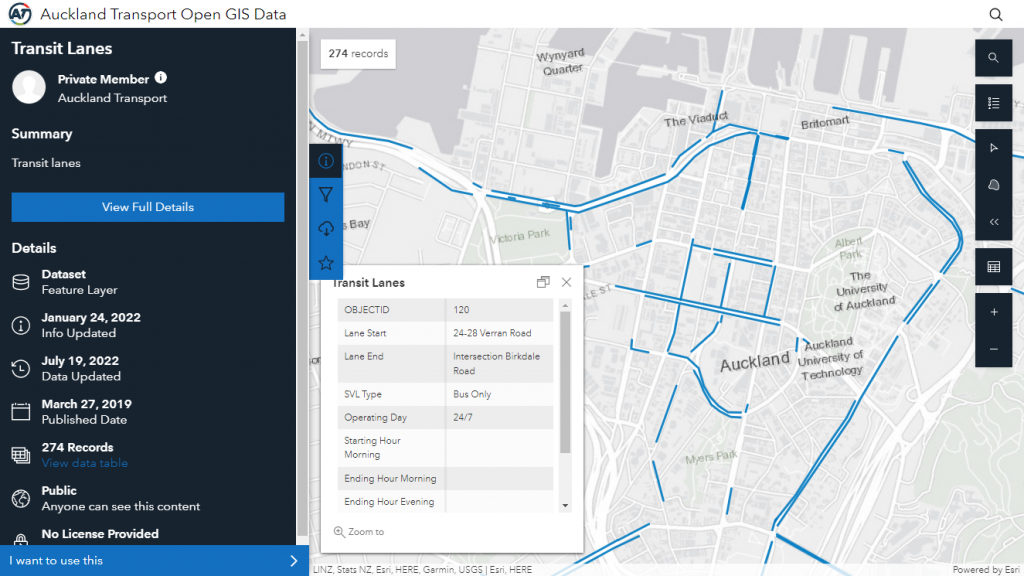

- This also comes on the back that of many events recently where people who are perceived to be committing real crimes with greater social and public harm are getting away with a slap on a wrist or just a warning while the ordinary member of the public who drove a few metres too long in the bus lane are slapped with a hefty $150 NZD fine which anecdotally is extremely difficult to get out of. This is the same monetary penalty as someone running a red light which by all accounts is a much more serious act with more material consequences.

- Another issue this situation brings up is that instead of the state being seen as an ally out to assist the lives of the ordinary tax-paying citizens, the state are increasing instead seen as an adversary out to get at them at any means possible in turn causing public to distrust those in power

- It potentially normalizes offences and offending. We are now seeing more and more people regard certain fines as just another tax and revenue generation (or “revenue raisers” more commonly used in Australia / Across the Tasman). It is also ultimately has the real potential of reducing the public’s regard or “respect of authority”.

- More significantly, the fixed nature of this penalty means those on the lowest incomes are the most impacted by the imposition of such fixed value monetary penalties. For those on low incomes, a $150 may mean a weeks worth of groceries and the inability to feed one’s family. For a more financial well off it may be a little mere a minor slap on the wrist.

The imposition of Automatic fixed camera bus lanes enforcement at fines of $150 is I feel a slippery slope in the wrong direction, a step too far already. This also confirms my anxiety as it were over what I originally saw back in Melbourne, Victoria Australia with respect to Victoria being a fine state increasingly being applied to New Zealand as well.