Short little walks around Clevedon and later on, a stroll around Eden Gardens. Click Picture below to access the gallery…

Random spur of the moment Road trip down to Hamilton and surrounds. Click picture to access Gallery…

While the Olympus TG-3 has served me well, the camera equipped with my Samsung S7 Active phone seems to have the TG-3 beaten hands down in the image quality department. The only thing the TG-3 has over my Phone is optical zoom. The Dynamic Range on the S7 Active is so far the best I’ve seen from any camera I’ve owned.

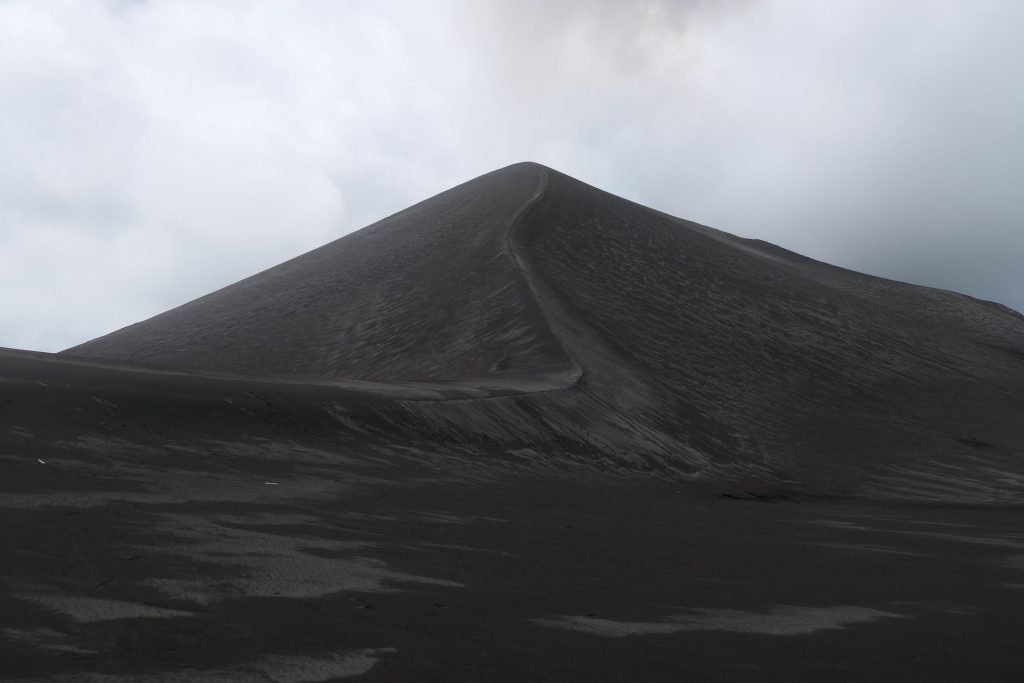

Trip to Vanuatu over Easter from 29th March 2017 to 7th April 2018 – Including Espiritu Santo (click pictures to view gallery)…

…and the island of Tanna to see the Active Volcano of Tanna

Sadly didn’t get my Helicopter trip to visit Ambrym this time around due to weather.

Apart from any up and coming work trips, I’m going dial back a little from traveling for a while, so the volume of trip photos will likely drop accordingly (Not that it really matters as such)

Update 27/06/18 – Facebook reaches 200 USD per share, Too bad we collectively keep rewarding bad behaviour, Thanks for the cap gains though.

—

Ironically, have discovered a lot of my time spent surfing the internet in the evenings is for researching about the Internet itself.

For all intents and purposes, It looks like older days of a largely decentralized Internet with inter-operable communication protocols (E-mail, XMPP, RSS) are pretty much going away, replaced by proprietary walled gardens operated by sole businesses for the primary purpose to maximize profits and designed to be sticky (addictive) and lock as many people in as possible so that it’s hard to escape.

Willful ignorance or otherwise, we collectively voted for this. People a decade ago remarked that I was “Oh So pessimistic” to suggest that Facebook would become as ubiquitous and as powerful as they are today. (By the way, Keep the glass, I don’t need it). Just a second while I write another put option on NASDAQ:FB (with the intention to add to my current holdings)

People keep getting outraged at Facebook’s behaviour, yet continues to reward and encourage it by continuing to use their services. While many have pledged to reduce their usage of Facebook (and other services), such actions seem to be nothing more than short lived and amounts to little more than “virtue signalling”, Furthermore, many of those people who say they are leaving Facebook are going on to suggest WhatsApp and Instagram (both owned by Facebook) as to where they will be moving to. Hold on, let me increase my short put position.

Frankly, a decade ago, I did state that I would prefer to lose my access to the Internet completely rather than submit to Facebook should Facebook happen to take over the Internet to become the Internet. While in truth, it’s still a long way from that, the situation is that the Internet has now become so commercialized with much of it’s power now consolidated into the hands of a few corporate entities.

Anyway, I’ve decided to gradually reduce my use of the Internet in general and should the consolidation of power continue, will probably end up using the Internet rather comparatively sparingly — Keeping any use personally during my own time to Administrative stuff and the keeping in touch with closer Family and friends (using self hosted services where possible) while completely cutting to the bone any superfluous usage such as casual surfing of forums and especially surfing the Internet to research… well, about the Internet.

A little walk around Pasifika Festival today, Small album of pictures posted to NUI.NZ.

With a surprise (to me) appearance of Jacinda Ardern along with Phil Goff (Mayor of Auckland).

Came earlier in the morning to avoid the crowds and the Afternoon Rain. Pacific Nations represented included, Hawaii, Fiji, Kiribati, Tonga, Samoa, Cook Islands, Tuvalu, Tokelau, Tahiti, Niue and of course Aotearoa. Full details on the ATEED website.

T’was handed info pack while walking past some stalls at Pasifika. A possible Career change from being a Computer nerd to a Corrections Officer? Not unheard of I suppose… It at least made me intrigued to look at what Corrections do.

In a lot of the “Just The Job” videos on Youtube… Lots of focus on rehabilitation, thought there was an acknowledgement that many offenders will “play the game”, get released only to return to prison again at a later date.

Currently Looking at the pay scale, If I ever was to take a front line position with Corrections, it would undoubtedly result in fairly sizeable drop in my pay.

First, here is something that I mildly found amusing…

As an aside, I don’t know about their business model anymore. I can’t say that buying from (or should it be through) them is necessarily the cheapest. While there are still bargains to be had, I have noticed that private individual sellers simply wishing to moved pre-loved goods on are getting fewer and fewer as years go by as they continue to get displaced on the listings pages by International Sellers or otherwise local drop-shippers, who often flood TradeMe with listings at asking prices higher than NZ RRP (Recommended Retail Pricing)… Continue reading “TradeMe – Not necessarily the cheapest place”

6th February 2018 – Waitangi Festivities at Okahu Bay at the Orakei Domain…

Hosted by Ngati Whatua Orakei in conjunction with Auckland Council Continue reading “Ngati Whatua Orakei Waitangi”

Day boat tour on Gulf Eco Charters‘ Launch “Kokomo”, with Kurt Salmond and his Family. Click Picture below to access the Gallery on NUI.NZ…

Departed Sandspit Yacht Club, around past Tawharanui where conditions was quite wavy, then direct to Taranga Island, part of the Hen and Chickens archipelago for our first snorkelling stop.

Then westward to the west side of the island where we anchored for a nice light lunch prepared by Clair (Kurt’s other half) of wraps and muffins.

We then cruised around north past West Chicken island before heading east towards Lady Alice Island where we anchored at Karimoko Bay for another spot of Snorkeling.

Aftewards, a short stop by Sail Rock and then a smooth cruise back to Base at Sandspit. Continue reading “Gulf Eco Charters Hen and Chicken Islands”

Over the New Year period, did a couple of road trips to explore around the Waiarapa region

First port of call was visiting Cape Palliser (Click Photo below to access gallery)

…and Putangirua Pinnacles (Click Photo below to access gallery) before diverting to Havelock North

A later attempt to finish off the road trip was made shortly after my King Country Road Trip, where I went to visit the Gallipoli The Scale of our War Exhibition at Te Papa. Click picture below to access the Photo Gallery

With a visit to Castle Point, Tinui ANZAC walkway and Stone Hedge Aotearoa (Click Photo below to access gallery) staying at Rusty Nail Lodge in Taihape on the way back.

If you are planning to drive in the state of Victoria, during your trip to Australia, please note…

Self Drive Tourism Warning

While I never received a fine during my Road trip in Victoria, Australia, many other foreigners including tourists and those newly emigrated to Australia haven’t been so lucky (much to their horror at how comparatively strict and expensive the penalties were). If you’re used to driving at the speed limit, there is less wiggle room for even a momentary lapse in concentration should you be in the vicinity of an enforcement camera.

In Australia, the ethos of the “Speed limit not being a target, but the absolute maximum speed you are allowed to drive at” is perhaps instilled a bit more vigorously than say in New Zealand or North America for that matter.

Victoria, Australia has some of the heaviest monetary penalties for speeding with fines that I’ve heard of, starting from 200 AUD for even just a few km/h over the speed limit along with 400 AUD fines for running red lights.

While as a foreigner you may be able to get away with not paying any infringements, issues may arise at the border should you wish to enter Australia again.

The reason I’ve heard for such seemingly heavy enforcement for low level speeding is that it’s “aimed at bringing about cultural change in the driving public”. Another words, an attempt at “Nipping it in the bud”. That said, Victoria still has their fair share of speeders (The occasional hooner that is clearly 30 km/h above the speed limit) and the usual tailgaters following other vehicles closely as anywhere else in the world.

Spur of the moment trip to visit a few places around King Country and Waitomo (Click Photo below to access gallery) staying at Grandad’s Cottage situated around the Taumarunui area both nights.

Pictures from the Heaphy Track, including a few off track explores to some caves. Click picture below to access the gallery on NUI.NZ…

Photos from a Caving experience on a private farm at Pio Pio. Thanks agasin to Suzie, Phil and Luke for their hospitality and having us scullywags. Click picture to below to access the gallery on NUI.NZ…

I have a confession to make, I do not understand present day Economics or financial markets.

To be honest, all I personally see is perhaps the biggest global asset bubble to ever grace the face of this planet. Many assets across the board appear to be valued well in-excess of their intrinsic value and have seemingly been like this for a lot longer than would ordinary be in a so called a bubbly situation.

Note May 2021: This post describes a hike that was done back in 2017 prior to being closed off due to Kauri Die Back concerns. The track has since reopened minus the Fletcher Track.

—

Trip notes for the Karamatura Valley and Mount Donald Mclean trail, a regular solo short to medium walk I regularly do. This will perhaps be my first attempt at documenting a trail in some sort of detail in a format inspired predominantly by MotoWalk NZ

In summary, A trek up through Fletcher Track up to Mount Donald Mclean and back via Karamutura Valley.

Expect around 5 hours at a gentle pace, including 30-40 minutes for a lunch stop at Mount Donald McLean and a 30-40 minute Swimming stop at the Base of Karamatura Falls (Actual walking time, about 3½ to 4 hours) Continue reading “Karamatura Valley and Mount Donald Mclean (2017)”