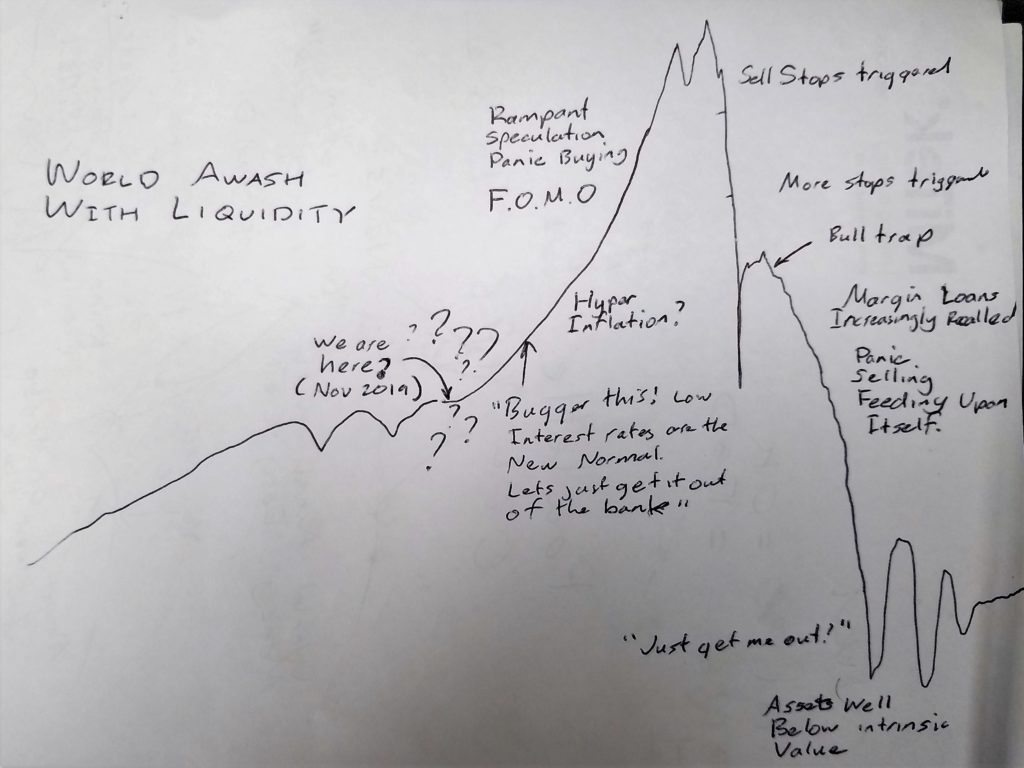

The theme has been the same for years. If the legion of economists and financial experts are to believed, the markets are over valued, the world is awash with money. We are totally hooked on cheap credit and a crash is imminent, but this ‘crash’ never ever seems to come. Indeed, even with me, my feeling is that a sizeable financial correction is extraordinarily well past overdue. The thing I feel hasn’t be covered in great deal is how might such a financial crisis end up being triggered? Hardly anyone I feel has actually really covered this in a great deal of depth.

It appears that as long as central banks keep “printing” Money (from thin air), this action appears to be very supportive of equities and the property market and is insulative of any world Crises that may ordinarily spoke the market. Unless anything untoward happens, Asset prices such as equities and property prices I feel will continue to escalate and may even accelerate in the short to medium term from here on in. There seems to be NOTHING that will cause a crash as long as central banks and commercial banks keep creating money and pumping it into the system by way of Fractional Reserve Banking.

There are however underlying risks at any time that can seemingly jump out of the blue and come bite everyone in the arse. When such an event will happen I believe it’s anyone’s guess as to when such a catastrophic event will happen and ultimately such an event is outside our ability to predict with any sort of usable accuracy. A correct prediction by anyone would basically be down to pure chance / luck. Statistically, someone will undoubtedly guess correctly and may get fawned over by the masses looking for any sort of answers as being some guru who had some insight.

The way the system is currently structured, if and when something does occur to be sufficient to get the boulder moving. The subsequent chain of events is going to be absolutely devastating. Once say a bank fails, there is a tendency for others to collapse along with it. Loans may be recalled, Entities stop investing, money stops flowing, More loans are recalled, People get laid off, Home owners may be forced to sell into a sliding market, trigger more loan recalls, panic selling ensues, Sell stops are triggered on stocks dumping more equities into the market, ultimately an unstoppable panic driven chain of events will be happening feeding upon itself in a frenzy and will undoubtedly drive asset prices to absurdly low levels.

So far the ‘Risks’ factors that I can see that may sufficiently trigger a crisis at some point.

- Some sort of Pandemic, similar to SARS or another airborne virulent infectious agent.

- Supply side shock of an essential resource, such as Food Shortages / Famine. An event such as plague, disease or disaster that ends up reducing the food supply. Food price going out of control, eventually leading to panic buying feeding (pun not intended!) on itself.

- Spreading Civil Global Unrest. In the case of Hong Kong and Chile, there were an underlying sense of discomfort. Civil unrest was often ignited by a single policy in the style of a feather breaking the camel’s back.

The reality is, I feel we haven’t learned very much if at all from the 2008 Global Financial Crisis. The credit and liquidity bubble I feel is a lot more lofty today than it was back in 2008 before the brown stuff had hit the rotating blades of the air-distribution device. The last run up of asset prices have almost, I feel, has been entirely credit driven and along with artificially low interest rates.

Indeed, with no end insight to current trajectory of asset price inflation from ever loosening monetary policy. Have been cautiously investing back into the equity market for the last 3 years.

Have up until recently been focusing my investments primarily towards REITs and Property Stocks, however, it would appear that ship suddenly sailed away from the start of this year catapulting the unit prices across the New Zealand REIT basket from below Net Tangible Asset Ratio to well above it. Additionally, prior was getting yield of 7% pre-tax on that sector, however, this has completely sunk down to a mere 3% dividend yield. Will cease adding any more to that sector and will be cancelling all Dividend Reinvestment plans, I feel this sector is now largely over valued.

The only other near term opportunity I can identify is possibly in some stable higher yielding companies, both here and abroad for which there are still plenty.

That said, am keeping a close eye on the pulse of the global economy. I think regardless though. If and when the next crisis comes and in spite of any safe guards taken, I’m still going to be reamed in some way whether I like it or not.

- See YouTube Video: DeustchWelle – Money Deluge

—

TL;DR – Financial System no longer obeying usual economic fundamentals. Unprecedented Flood of liquidity sees us potentially on the cusp of a relentless rampant run up in Asset and equity prices. The bubble may be about to inflate even more and faster than it has in the recent past. If something of sufficient severity does managed to spook the market and snow ball, then expect blood on the streets.