Pictures from a solo South Island Road Trip. Highlights include Roy’s Peak (in Wanaka) and Mueller Hut (Mount Cook National Park). Click Picture below to access the galleries.

Pictures from a solo South Island Road Trip. Highlights include Roy’s Peak (in Wanaka) and Mueller Hut (Mount Cook National Park). Click Picture below to access the galleries.

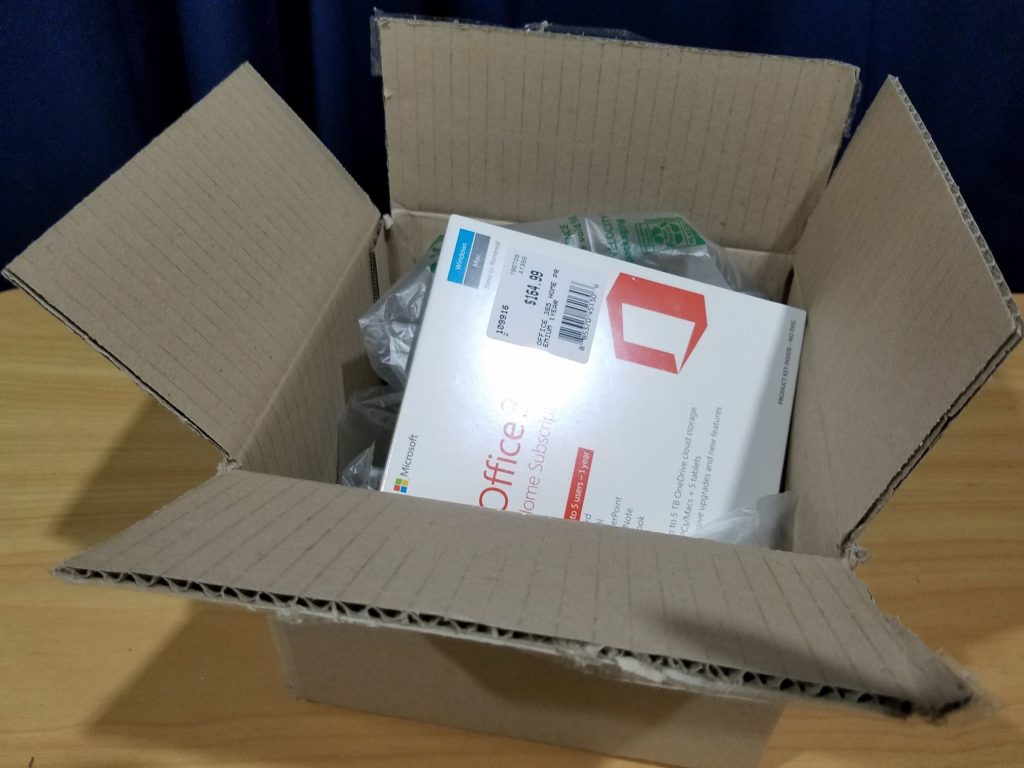

Well packaged for Delivery. Box containing a Microsoft Office 365 box wrapped in Air Pillows. The only important bit was a line of code to activate your Office 365 subscription online.

Of course an argument could most certainly be made that it would have been cheaper and easier to simply E-mail me the code… though obviously packaged like this as a “matter of process” / “Matter of course” and to their credit, it did showed that Noel Leeming takes the effort to ensure goods are packed in a way to minimize the chance of damage during transit.

It seems for (at least) Friday 8th December 2018 and Today, Saturday 9th December 2018, Air Vanuatu (NF) Flights that use the De Havilland Twin Otter aircraft have allegedly all been cancelled. Who the flip knows when they will be back in Action. Known locations affected include (but NOT limited to)…

Upon arrival to Craig Cove Airport on Friday (Yesterday) Morning, The agents in contact with Air Vanuatu head office keep announcing ever later estimated arrival times and relayed excuses from Head office from Mechanical Failure to the weather as reasons for the delay. After 2 hours of delay, ended up ringing Air Vanuatu Head Office myself, but they kept referring me back to the agents on the ground who in turn were similarly frantically via phone trying to get a grasp of the situation from Air Vanuatu Head office.

At about 4 hours after the flight was supposed to arrive, the agents announced that the flight had been cancelled and suggested that the next flight out of Craig Cove would be on Tuesday 11th December 2018 (Too late for me). Ended up calling a private charter flight to get us off of Ambrym allowing us to return back home to New Zealand as scheduled on the next morning.

Reviewing the flightradar24 upon finally returning home this Afternoon (As scheduled), it was revealed that all flights using De Havilland Twin Otter had been cancelled… Continue reading “Air Vanuatu Domestic Twin Otter Flights Cancellations”

Extended weekend spent in Tahiti. Click picture below to access the gallery and trip report…

Karangahake Rivers, being Ohinemuri and Waitawheta Rivers after sustained rained. Click picture below to access gallery…

Went to see the Super volcano showing at Stardome.

It is an older (2005/2006) film projected on to the dome ceiling of the Star dome. Being part of Stardome’s School Holiday Program, Family groups with Kids are likely to derive the most enjoyment from it.

The actual “Super Volcano” film clip (as shown in the trailer in the aforementioned link) runs for about 23 minutes starting from Indonesia and describing it’s lasting effect on the world, through the “Great Dying”, before zooming out and examining the volcanoes of other planets.

The remainder of the time was utilized as a generalized star light presentation of the Solar system, aimed primary at younger kids interested in astronomy. Total Run time for the content by itself is 40 minutes (Super Volcano film + Solar system presentation). No photos to show this time (as photography is prohibited inside the Stardome room itself)

May be alright value with Family groups on a $40.00 (+ Booking fee) Family pass. (In contrast to say a group of Adult aged friends at 13.50 each where it perhaps falls on the expensive side)

22nd July 2018 – Day Trip out towards the Dargaville direction to Hike up Mount Tutamoe Track and Hukatere Reserve (Both scheduled to be closed). Click picture below to access gallery…

Another spur of the moment (Snap decision) walk on Saturday 14th July 2018, this time around Te Arai and Mangawhai. Click Picture below to access gallery…

Quick Drop in visit to Kaipara Coast Sculpture Gardens en route back to Auckland. Click Photo below to access the gallery…

They recommend about 1 and half hours to walk around. Could easily spend 3 hours there if you include Don’s loop at a leisurely pace. Hills are moderate (Easy for a seasoned hiker, may be challenging for though for the less fit)

Walk with the Auckland Hiking Group Meetup to Waipu, click photo below to access gallery…

Weather was pretty Rainy through much of it, with fine breaks.

Short little walks around Clevedon and later on, a stroll around Eden Gardens. Click Picture below to access the gallery…

A little walk around Pasifika Festival today, Small album of pictures posted to NUI.NZ.

With a surprise (to me) appearance of Jacinda Ardern along with Phil Goff (Mayor of Auckland).

Came earlier in the morning to avoid the crowds and the Afternoon Rain. Pacific Nations represented included, Hawaii, Fiji, Kiribati, Tonga, Samoa, Cook Islands, Tuvalu, Tokelau, Tahiti, Niue and of course Aotearoa. Full details on the ATEED website.

T’was handed info pack while walking past some stalls at Pasifika. A possible Career change from being a Computer nerd to a Corrections Officer? Not unheard of I suppose… It at least made me intrigued to look at what Corrections do.

In a lot of the “Just The Job” videos on Youtube… Lots of focus on rehabilitation, thought there was an acknowledgement that many offenders will “play the game”, get released only to return to prison again at a later date.

Currently Looking at the pay scale, If I ever was to take a front line position with Corrections, it would undoubtedly result in fairly sizeable drop in my pay.

Spur of the moment trip to visit a few places around King Country and Waitomo (Click Photo below to access gallery) staying at Grandad’s Cottage situated around the Taumarunui area both nights.

I have a confession to make, I do not understand present day Economics or financial markets.

To be honest, all I personally see is perhaps the biggest global asset bubble to ever grace the face of this planet. Many assets across the board appear to be valued well in-excess of their intrinsic value and have seemingly been like this for a lot longer than would ordinary be in a so called a bubbly situation.

Explore of Motuora Island today with the North Shore Tramping Club. Lead by Imogen with Karen who took us there in the official Yellow bus. Photos posted to NUI.NZ, Click Image below to access the gallery…

Will add some more details in the next few days. (Right now I’m feeling really really sleepy, Apologies!)