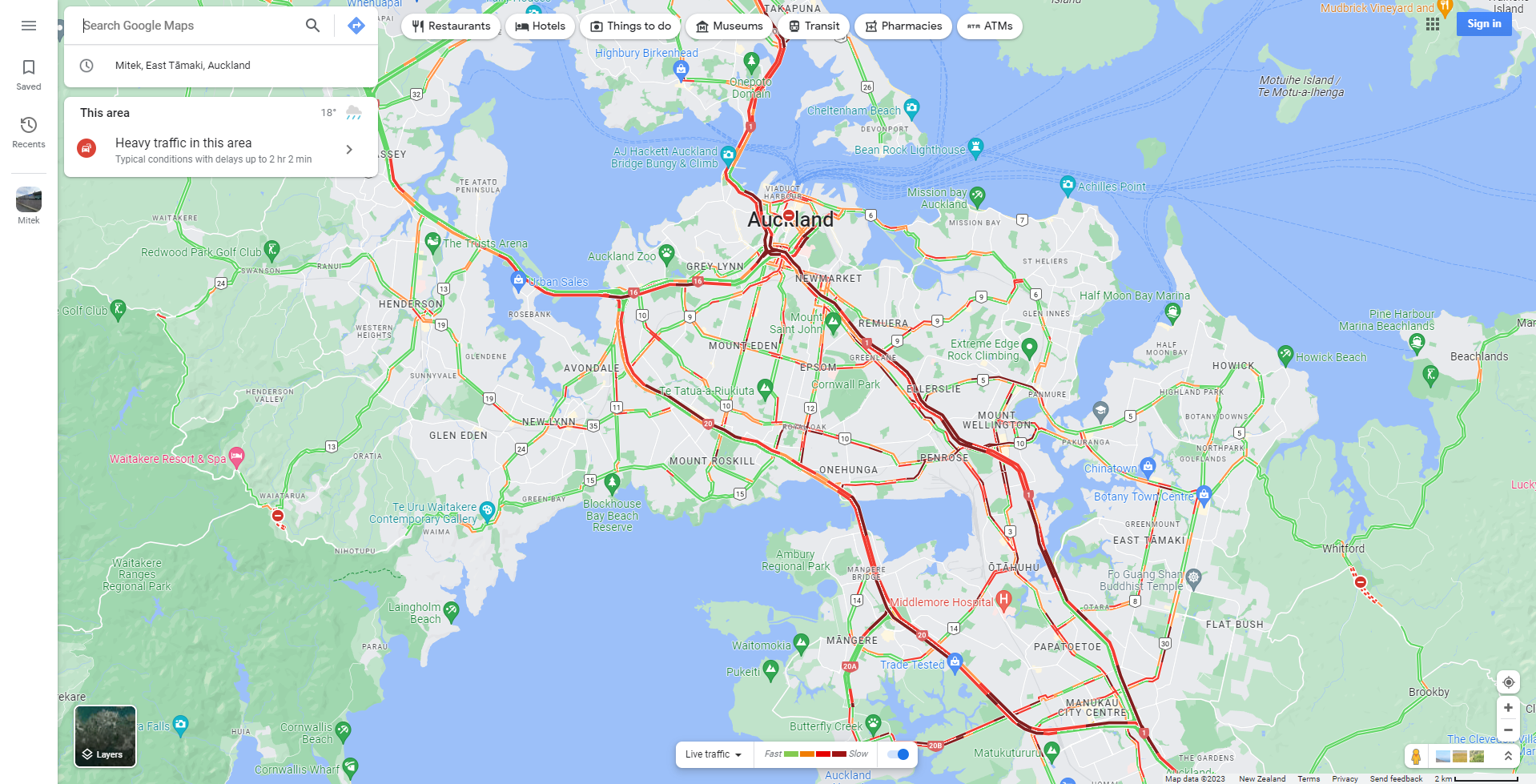

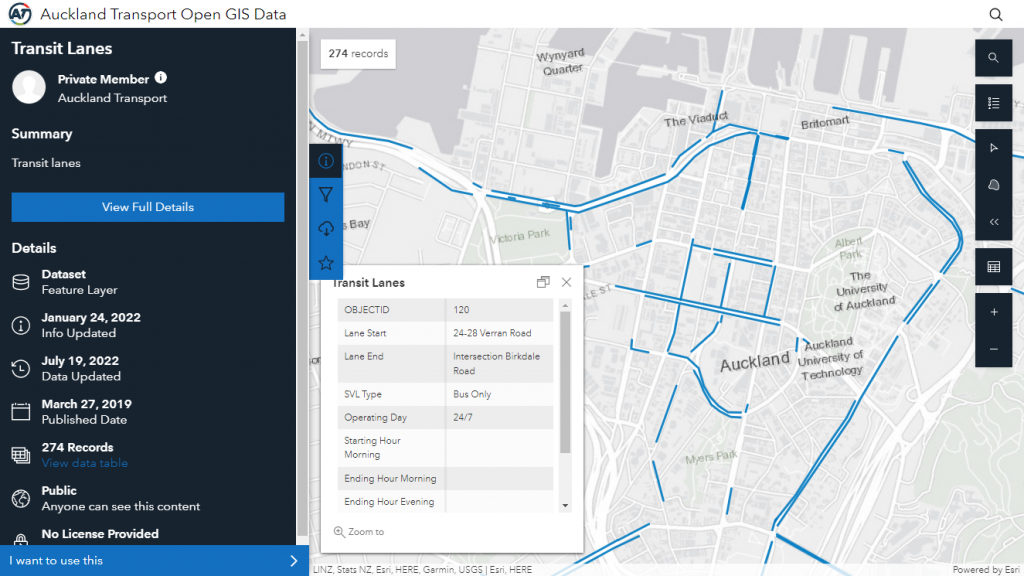

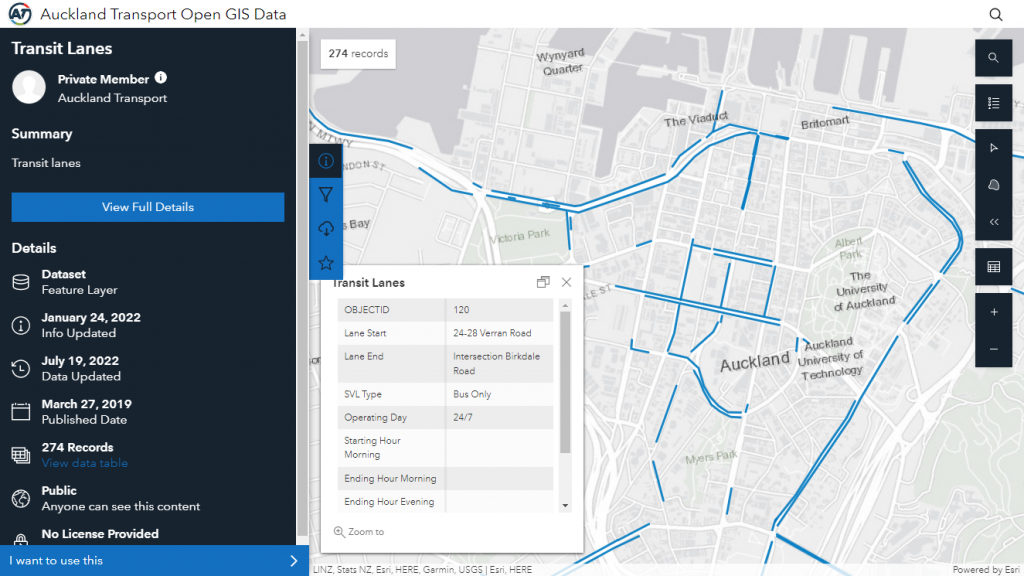

Was contemplating compiling a map myself of Auckland’s Bus Lane network, but it looks like Auckland Transport themselves have already created a Bus Lane and Special Vehicle lane map, albeit, one that is a bit out of date. (Will press Auckland Transport to update it, particularly Queen Street and Mount Wellington Highway).

Click here or the image below to access AT’s Bus lane / SVL Map…

Given the plethora of Bus Lanes and Special Vehicle Lanes popping up in Auckland recently catching many otherwise law abiding people unaware, I feel it has come to the point where motorists in all practical intents and purposes now have to consult this prior to heading out in order to avoid running foul of the rules and ending up with a $150 NZD fine.

Warning, rant incoming: While I’ve never received an infringement from AT for anything I’ve done and while I do support the idea of special vehicle priority lanes where implemented appropriately to aid High Occupancy Vehicles to move more freely, I am steadfast in my view Auckland Transport could be doing considerably more than they have to aid the public to comply. These include…

- Running advisory campaigns to advise the motoring public to please check for the latest information regarding bus lanes on the map (linked to at the top of this post)

- Ensure that as a public service any and all Bus Lanes, Transit Lanes and Special Vehicle lanes are swiftly updated and marked on the map as soon as they are laid down.

- Modify placement of bus lanes to aid people to easily merge into the general traffic lane. Right now, the way many bus lanes are drawn are pretty abrupt allowing drivers little chance to recognise and get out of the way of a bus lane.

- While AT already have videos online on how to use or drive on bus lanes, there is very little practical information for drivers to navigate around bus lanes. e.g what happens if you find yourself approaching a lane that you don’t know how to safely get out of?

As a personal opinion, while the “Green team” (being environmental advocates) seem to be the one’s advocating heavy handed (Orwellian-like Camera) enforcement in the name of a climate emergency, they run the real of risk of becoming tyrants themselves. As an aside, It’s almost like they are demanding that people immediately put both their livelihoods and current living arrangements on hold and comply with their demands on issues such as climate change and the environment (as in, stop driving our Internal Combustion Engine powered vehicles right away).

The issue I have with the current level of bus lane camera enforcement is that it pits Auckland Transport (as a CCO) against the very public they are supposed to be serving fostering a rather divisive and counter productive “Us” vs “Them” sentiment along with contributing to the general public’s erosion of respect towards Authority.

I also fear that this may be a slippery slope and unless strongly challenged, will encourage other government departments to copy Auckland Transport and start rolling out a regular fines regime to use against the public they are supposed to be serving.

Furthermore, it raises an issue with so many otherwise Law abiding people getting pinged over an ever increasing array of ‘Strict Liability’ offenses now suggests people who otherwise have the best intentions are now no longer able to go about their lives without worrying about the the state coming down on them for an innocent mistake.

I will admit, I feel very strongly about how Auckland Transport are currently handling this and feel their current stance is highly corrosive to their own public image and is actually causing the general public to turn against Auckland Transport and their initiatives. I am currently locked in ongoing discussions with Auckland Transport about their conduct, as a civic concern, urging them to reconsider their approach and offering suggestions as to what they could do instead to improve public guidance, and education in order to aid compliance around bus lanes.

Auckland Transport and the “Green team” (including the likes of the ‘Greater Auckland / Transport Blog‘ people) need to be “reading the room”, they need to realize they need the support and understanding of the public in order to progress with their vision of achieving a transportation modal shift in Auckland.

While I can totally understand sitting on a bus that has been impeded by cars is a frustrating and irritating experience, comments online that I’ve seen from advocates directed against general motoring members of the public that happen to unintentionally drive into a bus lane I feel is completely unhelpful, divisive and unproductive. Statements such as “Selfish Idiot” and “It’s SOOOOO simple, just stay out of the bus lane” reeks of a total lack of both consideration for others and understanding of the situation. Work with the public, not against the public.

Edited 22 November 2023: – Fixed some egregious spelling mistakes